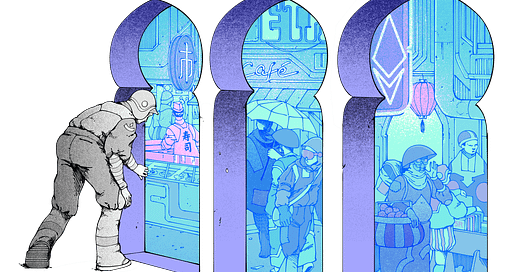

Rabbit Hole #6: The Blockchain

Pretty crazy that I didn't know how blockchains worked until this afternoon 🧱

I know, I’m really late to this. “Blockchain” was a buzzword in tech a few years ago, until it was superseded by “AI” and “machine learning” and others. Or maybe it was the other way around. I can’t remember. Whatever. The blockchain is the foundation of web3 and crypto, so it’s still pretty important, even if throwing the word around won’t necessarily …

Keep reading with a 7-day free trial

Subscribe to Hopeful Monsters to keep reading this post and get 7 days of free access to the full post archives.