Last week, I read the Bitcoin white paper1 to understand blockchains. It was a good read, actually. Not the worst kind of technical literature.

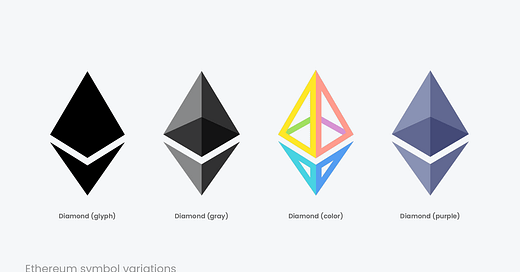

Ethereum can be seen as a successor to Bitcoin. It builds on the same idea — the blockchain — but it allows much more than transactions of digital currency. As a result, many crypto people, when you ask them for a…

Keep reading with a 7-day free trial

Subscribe to Hopeful Monsters to keep reading this post and get 7 days of free access to the full post archives.